A reconciliation of a bank or credit card account compares the statement to what is in QuickBooks. This is the same idea as balancing an account and checkbook in more manual times. You also need to ensure that the opening account balance shown in QuickBooks is correct. This is especially important the first time that you carry out a reconciliation. The opening balance should match your bank account balance period in question. If not, you’re most likely looking at an error in your books (or a bank error, which is less likely but possible).

How to Reconcile Previous Months in QuickBooks Online?

It also affects the beginning balance of your next income statement: what is it and how to do it reconciliation. Now, simply compare the transactions on your statement with what’s in QuickBooks. The tricky part is making sure you have the right dates and transactions in QuickBooks so you know everything matches.

Gather Bank Statement and Transactions

(If you’re in the middle of reconciling, stay on the page you’re on and skip to step 4). It can also help with account audits and tax preparation by catching errors early. During a reconciliation, you compare an account in the accounting system, such as QuickBooks, to its real-life counterpart to make sure everything matches. A reconciliation confirms the accuracy of the QuickBooks account. However, businesses with high transaction volumes might benefit from more frequent reconciliations.

It needs to match the balance of your real-life bank account for the day you decided to start tracking transactions in QuickBooks. When you create a new account in QuickBooks, you pick a day to start tracking transactions. You enter the balance bookkeeping tests of your real-life bank account for whatever day you choose. We recommend setting the opening balance at the beginning of a bank statement.

- Any discrepancies should be thoroughly investigated and adjusted in QuickBooks to reconcile the balances accurately.

- After confirming the match between the records and the bank statement, it is essential to review any discrepancies and make necessary adjustments.

- This step also streamlines the reconciliation process, allowing for a more efficient and error-free comparison between the company’s records and the bank statement.

- When reconciling an account, the first bit of information you need is the opening balance.

Upon confirming the reconciliation, understanding depreciation and balance sheet accounting the process concludes, showcasing the financial harmony between the records and the bank statement. It’s recommended to reconcile your checking, savings, and credit card accounts every month. Once you get your bank statements, compare the list of transactions with what you entered into QuickBooks.

Comparing transactions in QuickBooks with the bank statement is essential to identify any disparities and ensure the accurate alignment of financial records with the official bank records. Regular reviews help in detecting potential errors or fraudulent activities, thereby safeguarding the financial integrity of the business. It also streamlines the reconciliation process, providing a clear and up-to-date financial overview for informed decision-making. Reviewing transactions in QuickBooks Desktop is essential to identify any discrepancies and ensure that the recorded transactions correspond accurately with the bank statement. Reviewing transactions in QuickBooks Online is essential to identify any discrepancies and ensure that the recorded transactions correspond accurately with the bank statement.

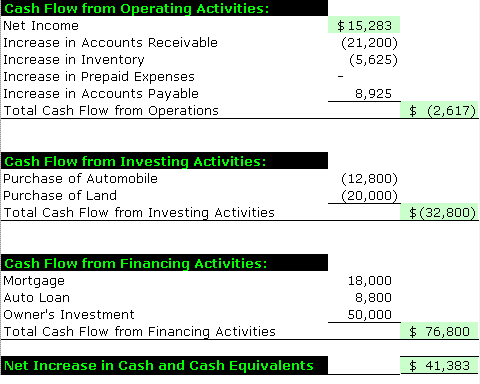

How to Reconcile Balance Sheet Accounts in QuickBooks?

Reconciling is an important task that you should carry out regularly. If a transaction is missing in QuickBooks, ensure that you haven’t accidentally omitted it. If it’s genuinely missing, add it manually to maintain alignment. If you forgot to enter an opening balance in QuickBooks in the past, don’t worry. After you reconcile, you can select Display to view the Reconciliation report or Print to print it.

The reconciliation process is concluded by affirming that the closing balances match, signifying the successful alignment of the financial records with the official bank statements. This finalization stage is vital for ensuring the accuracy and integrity of the financial data, providing a clear overview of the company’s financial position and allowing for informed decision-making. Accessing the reconcile window in QuickBooks Desktop is the initial step in the reconciliation process, enabling users to match the financial records with the bank statement and ensure accuracy. You’ll need a few items to perform a bank reconciliation, including your bank statement, internal accounting records, and a record of any pending cash transactions (either inflows or outflows).

Step 4: Reviewing Transactions

QuickBooks, a leading accounting software, stands as a crucial tool in this endeavor. Its advantage lies in its ability to streamline and enhance the account reconciliation process, thereby contributing to the overall financial health of an organization. Let’s delve into the specific advantages that QuickBooks brings to the table. If you reconciled a transaction by mistake, here’s how to unreconcile it.