ShyderChat

desenvolvido usando a api oficial do facebook

revolucionário, o primeiro e completo software de marketing do mundo para facebook e outras mídias sociais desenvolvido usando apis oficiais.

revolucionário, o primeiro e completo software de marketing do mundo para facebook e outras mídias sociais desenvolvido usando apis oficiais.

configure o bot do messenger para responder 24 horas por dia, 7 dias por semana, com o construtor de fluxo visual.

chat ao vivo com assinantes do facebook/instagram

template, ocultar/excluir comentário ofensivo, resposta baseada em palavras-chave, resposta genérica a comentários de postagens de páginas do Facebook.

postagem instantânea/agendada nas mídias sociais.

alguns passos para conectar sua conta do facebook e instagram e fazer este aplicativo funcionar.

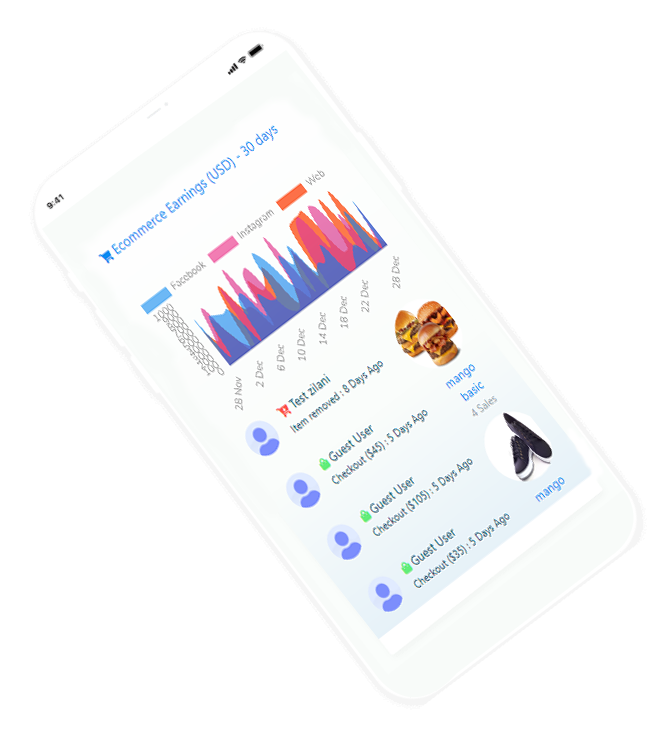

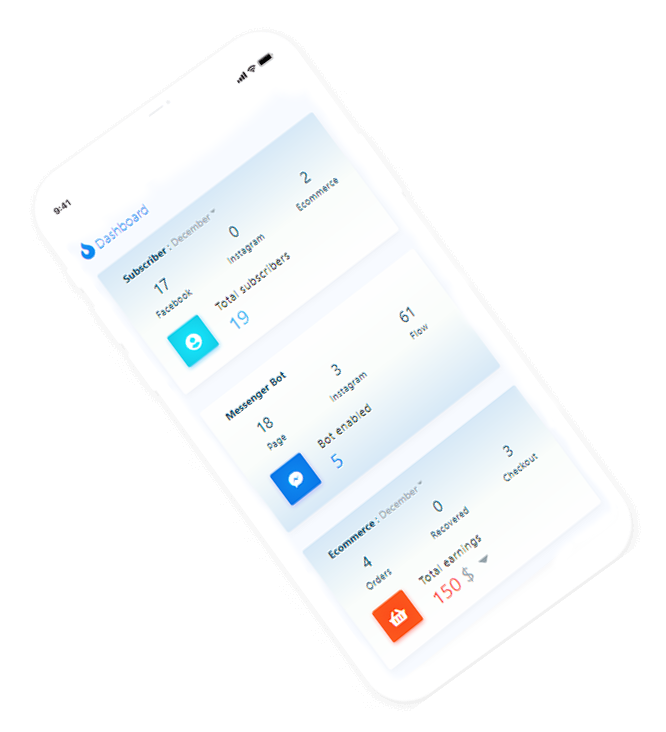

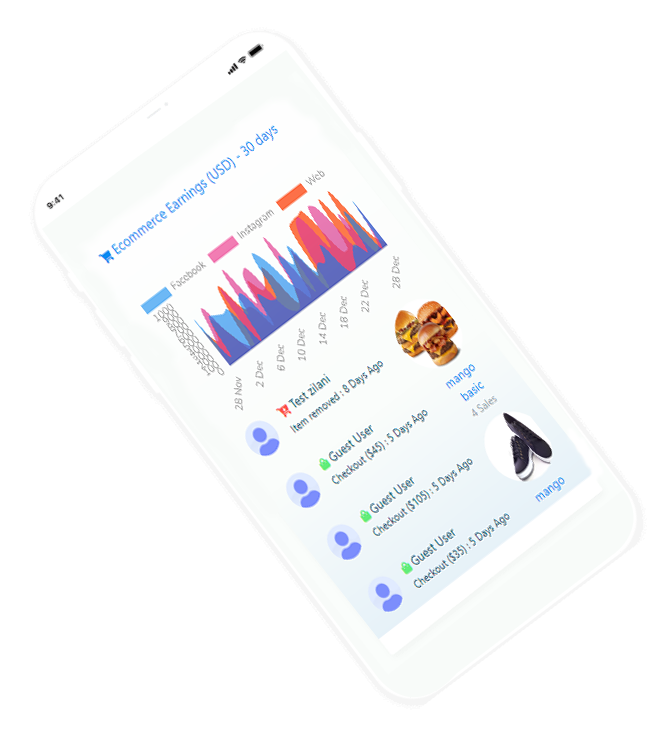

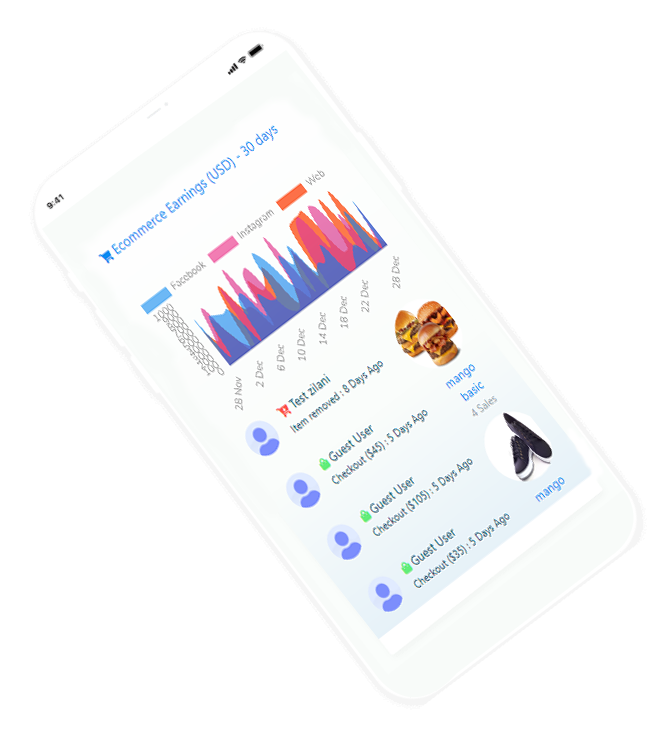

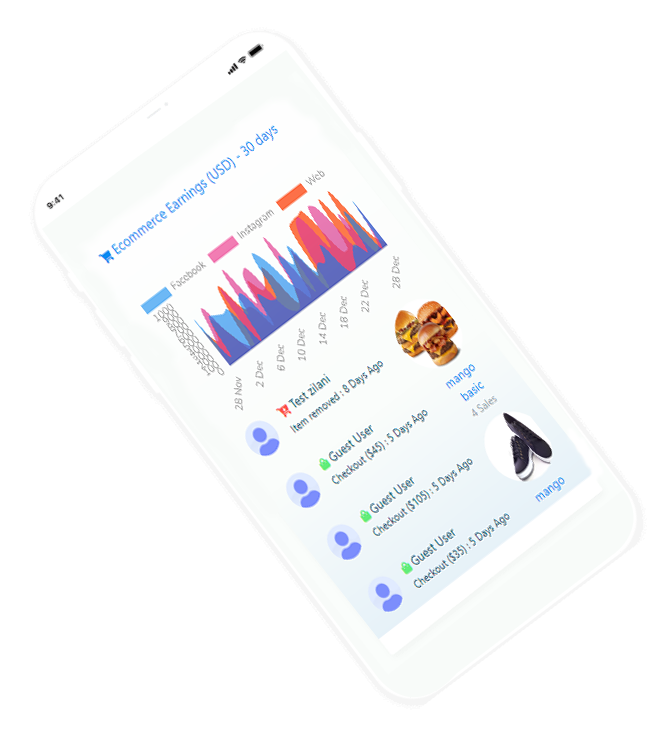

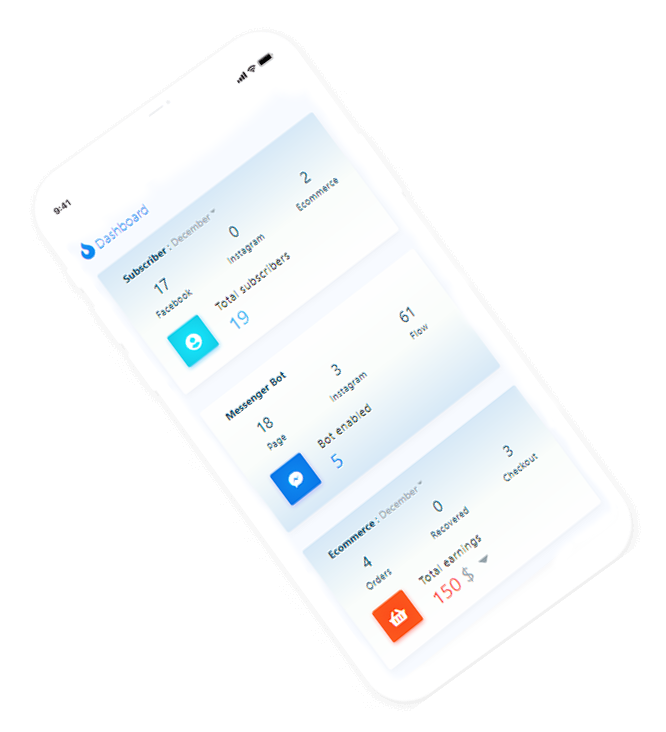

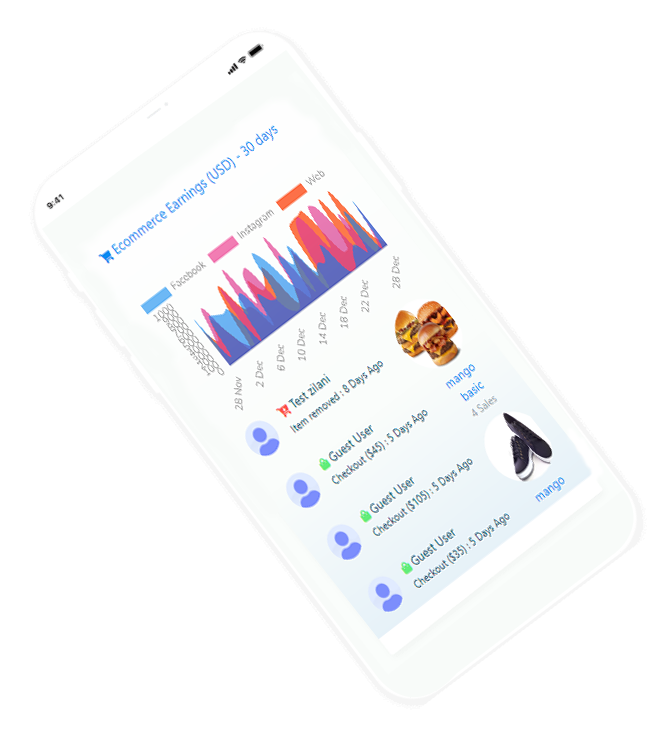

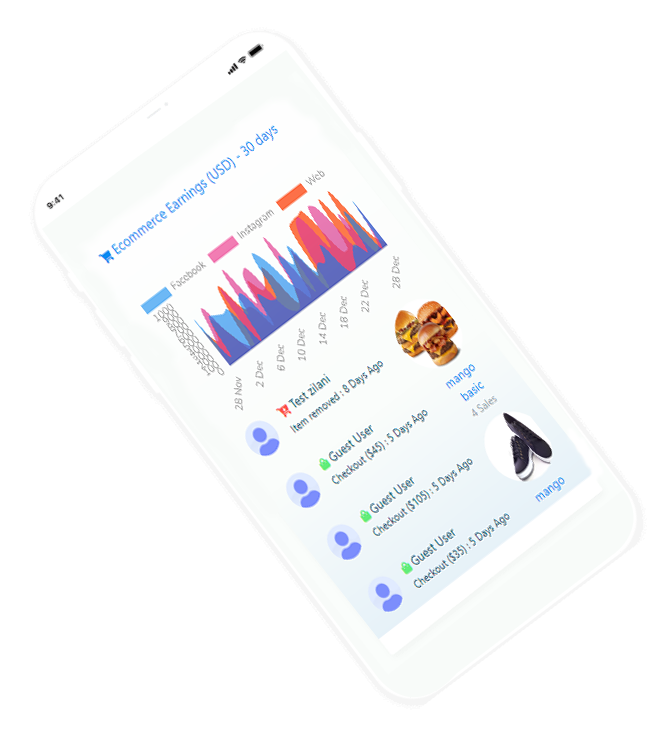

aqui estão algumas capturas de tela de como fica. veja as fotos incríveis e divirta-se.

nós fornecemos a você um pacote de teste, para que você possa ver a grandiosidade em ação e explorá-la mais.